Nurse Money Mastery: How to Decode Your Investments & Start Earning More

Apr 30, 2025

Welcome to Day 2 of the Nurses Investing For Wealth Rev Your Riches Challenge!

If you’re a nurse or APRN asking how to make the most money with what you already have, today’s your breakthrough.

Most people will tell you that investing is risky—or too confusing for nurses. That you weren’t taught this in school. That it’s dangerous to take control of your own accounts.

But here’s the truth: you already have everything it takes to manage your nurse money confidently.

All you need is to learn how to decode the financial word salad that’s been holding you back.

(Nurses & APRNs inside this challenge should have completed my in-depth–FREE–training first. If you haven’t done it yet, go here and start.)

Nurse Money Tip: Demystify Investment Jargon

In Video 1 of the Rev Your Riches Challenge, you learned how to locate your investments.

Today, we’re answering the next big question: What do these investments actually mean?

You’ll learn how to identify if what you hold is:

-

Stocks

-

Bonds

-

Cash

-

A combination

-

Or something else like real estate or crypto

Step 1: Decode the Investment Name (Nurse Money Tip)

Start by looking at the investment title. Often, the name tells you whether you’re dealing with stocks or bonds.

Example: Vanguard Total Stock Index Fund (Ticker: VTI)

-

The word "Stock" tells you exactly what you’re working with.

Here’s a quick translation guide you can use:

🔍 Investment Deciphering Key

-

Stock = Equities = Shares

-

Bond = Securities

-

Target Date Fund = Target Retirement Fund = A mix of stocks & bonds

-

Money Market = Settlement Fund = Cash (not a real investment!)

⬇️ Save this, screenshot it, and share it with a fellow nurse investor who needs it. ⬇️

Img: Investment Deciphering Key © Nurses Investing For Wealth

Step 2: Where Nurses Should Look When Investment Names Are Vague

Sometimes, the name won’t tell you much—especially if you’re looking at blended investments like Target Date Funds.

When this happens:

-

Click into the fund.

-

Look for categories like:

-

Holdings

-

Portfolio Composition

-

Asset Allocation

-

Portfolio Breakdown

-

Underlying Funds

-

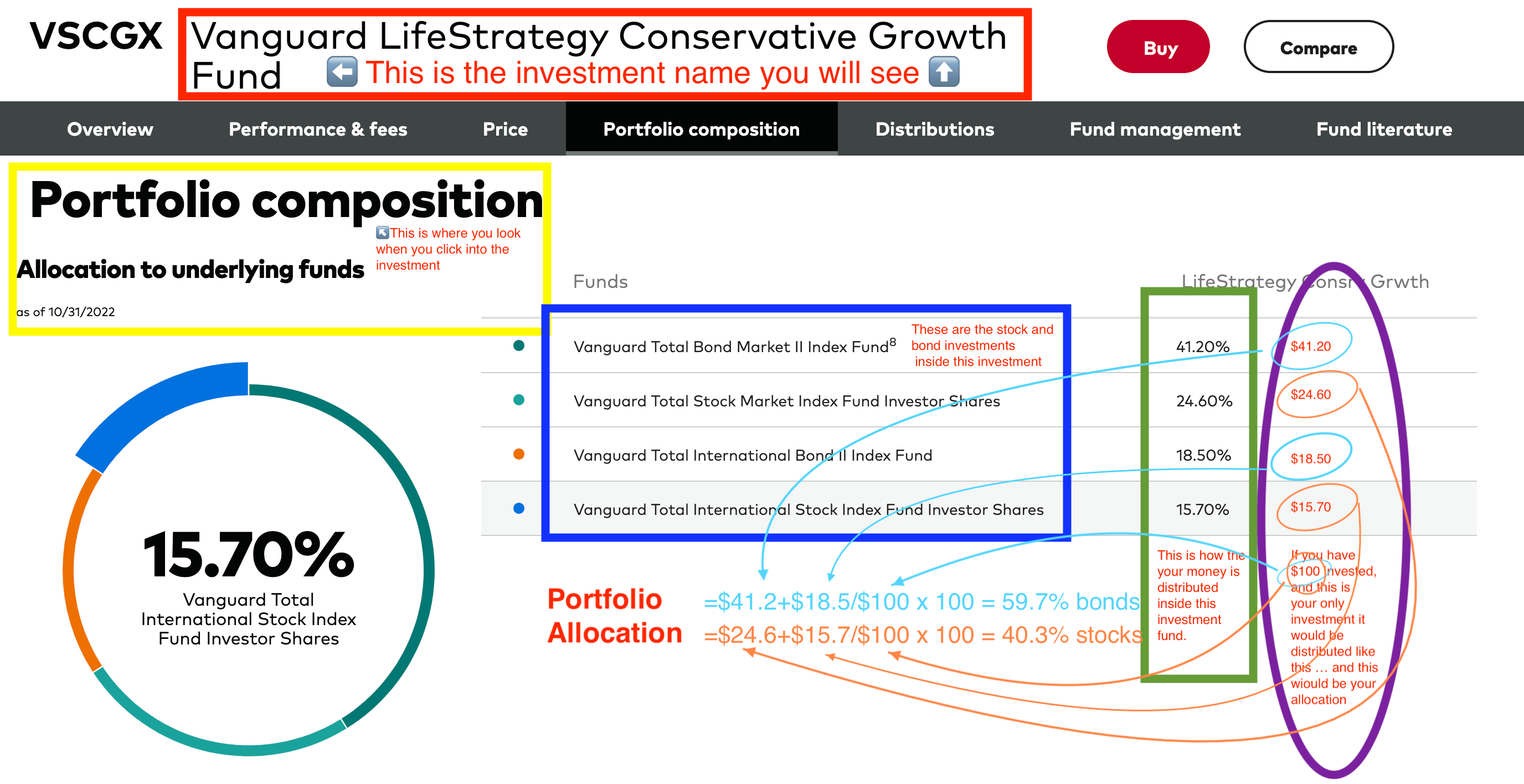

Example: Vanguard Target Date Retirement Fund

Img: Target Date Fund Interpretation

- RED: Fund name

- BLUE: List of underlying investments (inside the fund)

- GREEN: Percentage each investment gets

- PURPLE: Visual breakdown based on $100 invested

Each brokerage platform (Fidelity, Vanguard, Schwab, etc.) will look different, but these categories show up on all of them.

⚠️ Warning: It’s easy to get overwhelmed. Right now, just focus on identifying whether you’re in stocks, bonds, cash, or something else.

Nurse Money Tip: How to Calculate Your Stock vs. Bond Percent

Want to know your portfolio mix? Try this quick calculation:

🧮 Simple Formula:

Stock % = (Total in stocks ÷ Total invested) x 100

Bond % = (Total in bonds ÷ Total invested) x 100

Example:

You have $100 invested:

-

$90 in stocks = 90%

-

$10 in bonds = 10%

It’s a 90/10 portfolio.

💡 But don’t worry—there’s a shortcut.

Example: Portfolio Allocation Calculation Inside Target Date Fund

Img: Target Date Fund Portfolio Allocation

In BLUE calculating BOND portfolio allocation. Do that by adding the two bond totals together.

In ORANGE calculating STOCK portfolio allocation. Do that by adding the two stock totals together.

🌟 BONUS: My Portfolio Allocation Rebalancer Tool

If math makes your brain melt, you’re not alone.

I created a tool just for nurses: the Portfolio Allocation Rebalancer.

-

It does the math for you

-

It gives you clear percentages

-

It removes all confusion

I use it myself. It’s part of what nurses get access to inside my full program.

Homework

📋 Grab your Video 1 notes.

-

Review your investments.

-

Identify what’s stock, bond, cash. or other.

-

Estimate your percentage mix.

-

Share your homework in the FB group or reply to my email to get personal feedback from me!

Do your best and remember: tools exist to make this easy. You’re not expected to get it perfect right now.

📌 Nurse Money FAQs

Q: How can nurses make the most money investing?

A: Start by understanding what you own. When you know your portfolio mix, you can align it with your goals and adjust risk.

Q: Which nurses make the most money online?

A: Nurses who take charge of their money. That means learning what your accounts are doing—and using tools that make it simple.

Q: How do I make extra money online as a nurse investor?

A: By setting up your investments intentionally—not just automatically. This challenge walks you through it step-by-step.

What’s Next?

Now you might be wondering: “Okay… but what do these percentages actually mean?”

The answer? Risk.

And when you understand that, you’ll know how to make extra money online as a nurse investor—safely.

That’s exactly what we’ll cover in Rev Your Riches Video #3: Isn’t This All Too Risky?

🎥 See you in the next video!

—Angel 💚

…

Are you new here? The best place to start is here in my free 2 hour training.

💻 Free, On Demand, Video Training

Fellow Nurses: How to Become Work Optional in One Hour a Month–Without Burning Out, Wasting Time on One-Size-Fits All Finance Strategies, or Falling for Bogus Investment Ploys